Hello, everyone! Today, we’ll unpack U.S. President Donald Trump’s speech at a joint session of Congress on March 4, 2025, in Washington, D.C., where he highlighted South Korea’s role in the Alaska gas pipeline, South Korea’s participation, and tariff issues.

The Alaska Gas Pipeline Project: History and South Korea’s Potential Role

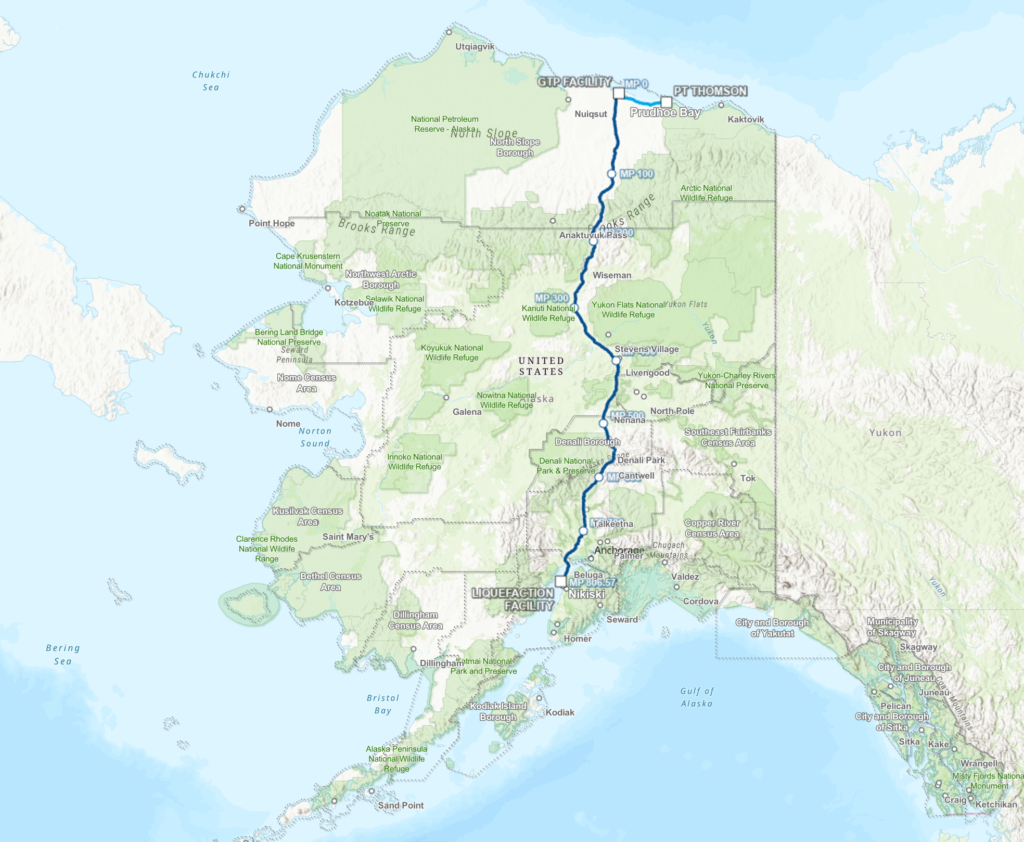

Trump announced, “My administration is constructing a gigantic natural gas pipeline in Alaska, one of the largest in the world. Japan, South Korea, and other nations want to join us as partners, investing trillions of dollars each. This is a historic first and will be an incredible achievement.” The Alaska gas pipeline project aims to tap into the immense natural gas reserves in Prudhoe Bay and the Arctic, building an 800-mile (1,287-km) pipeline from the North Slope to the ice-free ports of Valdez or Nikiski. Upon completion, it could export 20 million tons of LNG annually—equivalent to 42% of South Korea’s yearly LNG imports (47 million tons).

This initiative dates back to the 1970s but faced delays due to its $44 billion cost and environmental restrictions. Web research reveals that the Alaska state government pushed the project in the early 2000s, only to be stalled by federal regulations (source: Alaska Gasline Development Corporation). Trump’s first-term executive order in 2017 to promote Alaska’s resource development changed the game, securing key federal permits in 2020. As of 2025, the Alaska Gasline Development Corporation (AGDC) is maintaining these permits while courting investors.

For South Korea, participation offers more than a financial stake. As the world’s second-largest LNG importer, South Korea could secure 20 million tons annually, diversifying its energy supply. The maritime route from Valdez to Busan (6,000 km) is notably shorter than from Qatar (9,500 km) or Australia (7,000 km), reducing costs and enhancing reliability. South Korea also brings expertise in pipeline construction, LNG infrastructure, and shipbuilding. With Hyundai Heavy Industries and Samsung Heavy Industries dominating 70% of the global LNG carrier market (source: Statista, 2024), South Korea is well-positioned to secure contracts, especially since the U.S. is unlikely to favor China.

Alaska Senator Dan Sullivan, in a February 5, 2025, CSIS discussion, said, “South Korea and Japan importing Alaskan LNG counters China’s influence over Qatar, with U.S. naval escorts ensuring stability.” Japan’s JERA has expressed investment interest, and South Korea’s KOGAS is evaluating the project. In a March 6, 2025, Yonhap News interview, KOGAS noted it’s assessing “economic and geopolitical benefits.” The $44 billion cost remains a challenge, necessitating a cost-sharing model with Japan and Taiwan.

Alaska Gas Pipeline Map

Tariff Issues: Trump’s Claims, South Korea’s Rebuttal, and Hidden Motives

Trump also raised tariff issues, stating, “Countless countries impose far higher tariffs on us than we do on them. South Korea’s average tariff is four times higher than ours. We support them militarily and in many ways, yet this unfairness persists.” This triggered a swift response from South Korea.

The 2012 Korea-U.S. FTA ensures near-zero tariffs on most goods between the two nations. Korean semiconductors, cars, and U.S. oil and LNG trade tariff-free. South Korean media, citing a 0.79% effective tariff rate on U.S. imports, labeled Trump’s claim inaccurate (source: Edaily, March 5, 2025). However, Trump was referring to the MFN (Most-Favored-Nation) average tariff rate—13.4% for South Korea versus 3.3% for the U.S. in 2023, per WTO data—a fourfold difference. This applies to non-FTA items, primarily agricultural products like rice (excluded from the FTA) and beef (subject to quotas and safeguards).

Trump’s statement reflects political strategy, not just statistics. With farmers as a key constituency, he’s pressing South Korea to open its agricultural market further. The U.S. Department of Agriculture has long pushed for expanded quotas, a priority Trump championed (source: USDA, 2024). South Korea’s trade ministry countered, “Over 90% of items are tariff-free under the FTA,” but agriculture remains a sensitive sticking point.

US President Trump’s speech

Implications and Strategic Responses for South Korea

The Alaska gas pipeline presents South Korea with multifaceted opportunities. Securing 20 million tons of LNG annually could reduce Middle East dependency and bolster energy security. Korean firms could profit from construction, LNG plants, and shipping contracts, while deepening U.S. ties. A collaborative approach with Japan and Taiwan to share costs and gas rights is essential, as Sullivan called it “a counter to China’s Belt and Road.”

Conversely, tariff issues risk trade tensions. Trump’s planned reciprocal tariffs from April 2, 2025, could impact South Korea’s semiconductor, auto, and battery exports. South Korea has increased U.S. LNG imports—up 10% to 5 million tons in 2024, per the U.S. Energy Information Administration (source: EIA, 2025)—to balance trade. The FTA remains a strong negotiating tool.

In conclusion, South Korea’s participation in the Alaska gas pipeline could yield energy and economic gains, but requires international cooperation. Tariff issues demand deft diplomacy, leveraging the FTA while addressing agricultural sensitivities. What are your thoughts on Trump’s speech and South Korea’s next moves? Let’s discuss in the comments!