Introduction: Trump and the Ukraine Rare Earth Controversy

Recent reports have spotlighted Donald Trump’s demand for half of Ukraine’s rare earth elements (REEs) as compensation for wartime aid, sparking debates about a potential minerals agreement between the U.S. and Ukraine. Such a request—half of a nation’s rare earth reserves—seems exorbitant and impractical, and Trump likely knows it. This raises a critical question: what’s the real reason behind Trump’s fixation on Ukraine’s rare earths? In this article, we’ll explore the significance of rare earths and uncover Trump’s possible strategic motives.

What Are Rare Earths and Why Do They Matter?

Rare earths refer to 17 scarce elements vital to modern technology. From smartphones to electric vehicles and advanced weaponry, these materials are indispensable. Take the iPhone, for instance—launched by Steve Jobs in 2007, it ushered in the rare earth era. Its glass contains indium, its vibrant screen uses europium and terbium, and its camera and speakers rely on neodymium.

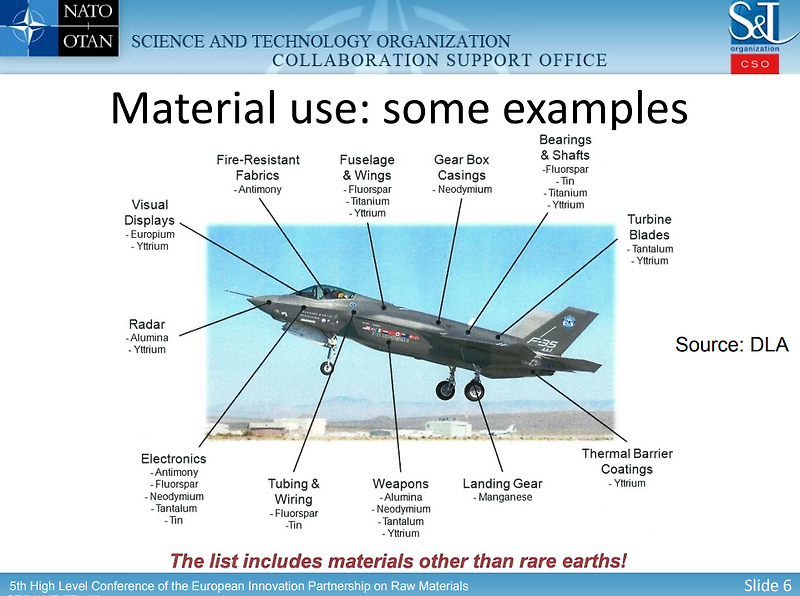

These elements act like a pinch of seasoning, enhancing products to be smaller, faster, and stronger. In military applications, an F-35 stealth fighter requires 417kg of rare earths, primarily in neodymium-iron-boron (Nd-Fe-B) magnets, underscoring their strategic value.

Trump’s Historical Connection to Rare Earths

Trump’s interest in rare earths dates back to 2017, when he issued an executive order to assess the U.S.’s critical minerals. The findings revealed that rare earths were essential to national security and that America was overly reliant on China. Consequently, Trump shifted rare earth oversight to the Department of Defense, a policy continued under Biden, who included rare earths among four key areas (batteries, semiconductors, critical minerals, pharmaceuticals).

China currently dominates, producing 70% of global rare earths and over 75% of Nd-Fe-B magnets. This stems from the 1995 sale of Magnequench, a GM subsidiary, to a Chinese state-owned firm, transferring critical technology. Trump aims to counter this dependency by securing alternative rare earth sources.

Dysprosium, the Crown Jewel of Rare Earths

Among the 17 rare earths, dysprosium stands out. When added to neodymium magnets, it ensures performance under high heat, making it crucial for electric vehicle motors and wind turbines. A 10-megawatt wind turbine, for example, uses 2 tons of neodymium magnets, including 160kg of dysprosium. Yet, dysprosium is scarce, with viable deposits mostly in China and Myanmar.

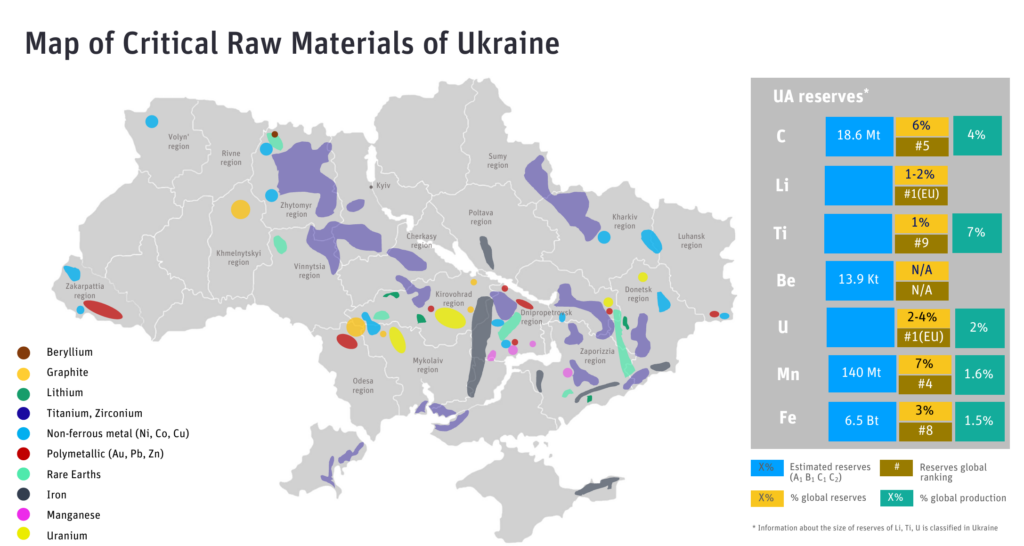

Trump’s interest in Greenland also ties to dysprosium. Greenland’s Kvanefjeld and Tanbreeze mines hold 44% of the world’s heavy rare earths, with the latter acquired by U.S.-based Critical Metals (CRML). Ukraine, however, is rich in light rare earths, not dysprosium.

Trump’s Hidden Agenda: Ukraine as a Processing Hub?

Trump’s obsession with Ukraine’s rare earths may extend beyond mere extraction. While Ukraine lacks significant dysprosium, it boasts abundant light rare earths like cerium and lanthanum. Its vast territory and areas devastated by the Chernobyl disaster offer a potential processing hub with lax environmental oversight.

Rare earth processing is notoriously polluting. In China’s Jiangxi province, ammonium sulfate dissolves clay to extract dysprosium, generating 75,000 liters of acidic wastewater per ton. Strict regulations make this unfeasible in the U.S. or Australia, but Ukraine’s war-torn landscape could serve as a workaround. Trump may envision Ukraine as a Western rare earth processing base to reduce reliance on China.

The Feasibility of a Ukraine Minerals Agreement

As of February 2025, U.S.-Ukraine minerals agreement talks are ongoing. Trump’s initial $500 billion demand was likely exaggerated—Ukraine holds titanium, lithium, and graphite, but 40% of its eastern mines are under Russian control due to the war. Experts estimate development could take 10-15 years, casting doubt on Trump’s ambitious timeline.

Conclusion: Trump’s Strategy and Future Outlook

Trump’s focus on Ukraine’s rare earths is a calculated move for national security and economic dominance. By leveraging Ukraine as a processing hub, he could disrupt China’s rare earth monopoly and bolster Western supply chains. Yet, war, environmental challenges, and technical hurdles temper this vision’s feasibility. Whether Trump’s minerals agreement succeeds or remains political rhetoric is a question worth watching.