Introduction: What Are China’s Two Sessions?

On March 4, 2025, China’s Two Sessions (Lianghui) kicked off with a week-long agenda, drawing global attention. This annual event, comprising the Chinese People’s Political Consultative Conference (CPPCC) and the National People’s Congress (NPC), serves as a window into China’s political and economic intentions. In 2025, the spotlight is on economic stimulus, AI (artificial intelligence) development, and private sector promotion, signaling that China is ready to inject significant resources into its economy. This article explores the key takeaways from the 2025 Two Sessions, delving into their implications, including shifts in iron ore and copper prices.

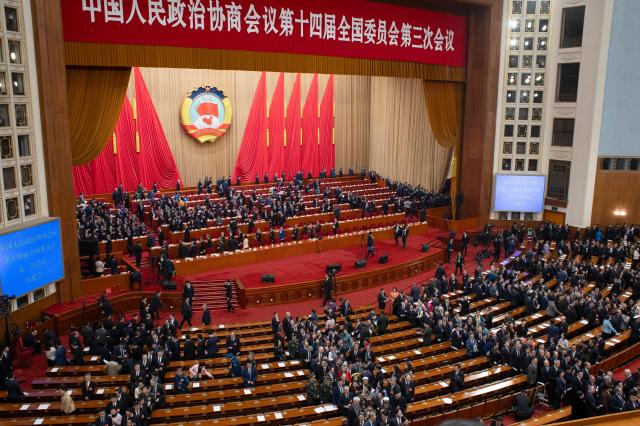

China Two Sessions Opening

The Structure and Significance of China’s Two Sessions

China’s Two Sessions bring together two distinct bodies: the CPPCC and the NPC. The CPPCC, with around 2,000 representatives from 34 sectors including ethnic minorities and religious groups, acts as an advisory body. The NPC, on the other hand, gathers approximately 3,000 delegates elected from provinces, autonomous regions, and municipalities to legislate and set national policies. A key highlight is the presentation of annual plans by local governments, which are harmonized to form China’s overarching economic strategy—akin to provincial planning in South Korea.

In 2024, the Chinese Communist Party set a growth target of around 5%, focusing on boosting domestic demand and stabilizing the stock market. The 2025 Two Sessions build on this, amplifying efforts with economic stimulus and AI as central pillars.

Core Themes of the 2025 Two Sessions: Economic Stimulus, AI, and Private Sector Growth

1. Economic Stimulus: Trade-In Programs and Fiscal Expansion

China is doubling down on its “trade-in” policy (Yijiuhuanxin) to stimulate domestic consumption. This initiative provides subsidies for replacing old cars, appliances, and furniture with new ones. Following the 2024 Two Sessions, the Ministry of Commerce rolled out detailed measures in April, which local governments like Shanghai expanded. For instance, purchasing a 7,600-yuan (about $1,070) energy-efficient air conditioner in Shanghai can cost less than 5,000 yuan after discounts and subsidies—a 30-40% reduction that has boosted sales significantly.

Moreover, China has raised its fiscal deficit target from 3% to 4%, a clear sign of aggressive economic stimulus. According to China Daily, the Central Economic Work Conference in December 2024 stressed “more proactive fiscal policies,” a stance likely to be fleshed out in 2025.

2. AI Development: The Heart of New Quality Productivity

AI takes center stage in 2025, building on the “new quality productivity” framework from the 2024 Third Plenum. This includes seven key areas: next-gen IT, AI, aerospace, new energy, advanced equipment, biomedicine, and quantum tech. China’s homegrown AI model, DeepSeek, has emerged as a flagship example, rivaling global leaders like ChatGPT. Local governments will unveil detailed plans at the Two Sessions to turn these priorities into action.

China AI, Aerospace, Information Technology

3. Private Sector Promotion: A Shift from State-Led Growth

Reversing the “state advances, private retreats” (Guojinmintui) policy of the 2018 U.S.-China trade war era, China is now prioritizing its private sector. This shift acknowledges past setbacks, such as leadership purges at firms like Alibaba, and aims to revitalize economic growth through private enterprise. The anticipated Private Economy Promotion Law, discussed at the Two Sessions, will likely focus on property rights protection and fair competition.

Iron Ore and Copper: Symbols of Economic Transition

The Two Sessions’ policies reverberate through commodity markets. Iron ore, once fueled by high-speed rail and real estate booms, faces declining demand due to vacant properties and a slowing Belt and Road Initiative (BRI). BRI partner countries’ debt ratios have surged from 35% to 126% on average, stalling projects and shrinking iron ore consumption. Conversely, copper demand is rising, driven by AI, electric vehicles, and solar energy—sectors dubbed “copper hogs.” Reuters predicts a 5%+ increase in copper demand in 2025, highlighting a divergence from iron ore trends and offering new investment prospects.

China Iron Ore Production

Conclusion: The Global Ripple Effects of China’s Two Sessions

The 2025 Two Sessions underscore China’s bold move to revitalize its economy through aggressive stimulus, AI innovation, and private sector support. From trade-in subsidies to a 4% fiscal deficit, short-term consumption is being prioritized, while AI signals long-term industrial ambition. The contrasting fates of iron ore and copper reflect this strategic pivot. For global investors and businesses, including those in South Korea, understanding these shifts is crucial to navigating China’s economic trajectory in 2025 and beyond.