Hello, everyone! Today, we’re taking a deep dive into President Trump’s escalating tariff war, which started with steel and aluminum and is now poised for even bolder trade strategies. We’ll analyze Trump’s plans, the global implications, and what this means for South Korea, weaving in rich details and additional insights.

1. Steel Tariffs and the Political Fate of US Steel

Since his first term, Trump has been laser-focused on steel tariffs to shield American industries and jobs. Biden carried this torch, prioritizing domestic steel protection, with US Steel at the heart of it all. Founded in 1901 by Andrew Carnegie and JP Morgan, US Steel was a powerhouse, producing 35 million tons of steel in its 1953 peak—67% of U.S. output. Today, despite a 2024 operating profit of $180 million, it reported a $210 million Q4 loss, highlighting its fading competitiveness.

In December 2023, US Steel agreed to a $14 billion acquisition by Japan’s Nippon Steel. This triggered a political uproar. Headquartered in Pennsylvania—a pivotal swing state with 8 Democratic and 4 Republican wins in the last 12 elections—US Steel became a lightning rod. Biden’s 2020 victory here (50% vs. Trump’s 48.8%) clinched the presidency, and historically, Pennsylvania’s winner has taken the White House 10 out of 12 times.

With 40,000 workers and 850,000 steel union members opposing the Nippon Steel takeover, both leaders intervened. On March 14, 2024, Biden declared, “US Steel must remain American,” vowing to block the deal. Trump, equally vocal, said, “I’m totally against it. With tax breaks and tariffs, I’ll make American steel strong again—fast.” Post-summit with Japan’s PM Ishiba, Trump noted Nippon Steel wouldn’t take a majority stake, shifting the deal to a 49% investment. If the takeover isn’t finalized by June 2025, Nippon Steel faces a $565 million penalty, though litigation seems unlikely given the bilateral agreement.

Reviving US Steel still requires tariff walls, as broader competitiveness issues persist beyond simple trade protections.

Nippon Steel & US Steel Factory

2. Aluminum Tariffs: Curbing China, Lifting Australia

Distinct from steel, aluminum tariffs target China while boosting Australia. China has poured over $100 billion into Guinea, the world’s top bauxite reserve holder, securing 60% of its bauxite imports. Producing one ton of aluminum requires 5-6 tons of bauxite, making Guinea vital. But a 2021 coup in Guinea shifted the landscape. After President Alpha Condé’s controversial third term via constitutional tweaks, a coup led by Colonel Mamady Doumbouya—a French Foreign Legion veteran trained in Israel—toppled him. Unlinked to China, Doumbouya halted coal exports and the Simandou iron ore project, where Chinese firms held an 85% stake worth $32 billion.

Guinea’s sporadic bauxite export curbs hit China’s aluminum supply chain hard. Australia seized the moment. Trump slapped a 25% tariff on Chinese aluminum while exempting Australia, enhancing its edge. On February 11, 2025, Australia’s PM confirmed Trump’s agreement to align steel and aluminum tariffs for mutual gain. Trump said, “Australia’s one of the few surplus nations ($17.9 billion) and buys lots of our planes.”

Aluminum’s role spans aerospace, automotive, and construction. The U.S. Aluminum Association notes that two-thirds of U.S. primary aluminum comes from Canada, with 90% of scrap from Canada and Mexico. Trump’s tariffs could reshape these supply chains significantly.

Trump’s US in tariff war with Mexico and Canada

3. Trade Balance and South Korea’s Strategic Response

Trump’s trade policy hinges on trade balance, splitting nations into surplus and deficit categories. China leads U.S. deficits at $295.4 billion, while South Korea ranks 8th with a $66 billion surplus. As the 4th-largest steel exporter to the U.S. (2.8 million tons in 2024), South Korea’s Posco and Hyundai Steel supply Hyundai and Kia’s U.S. plants. A 25% steel tariff from March 2025 could spike car production costs, given each vehicle uses about one ton of steel.

Hyundai Steel’s countermeasure is a $7 billion U.S. steel plant, set to break ground in 2026 and produce 3 million tons annually by 2029 for Kia and Hyundai factories in Georgia and Alabama. Supplying 1 million tons locally, the rest could serve other automakers. Critics argue the announcement was premature—leveraging it in Trump talks might have secured tariff relief.

Trump’s shift from “reciprocal tariffs” to “reciprocal trade” hints at tougher demands on deficit-heavy nations. Despite KORUS FTA benefits, South Korea’s surplus may force concessions. Cars and semiconductors, 35% of its $127.8 billion U.S. exports, face ripple effects from steel tariffs.

South Korea could have pitched its steel plant as a gift to Trump’s “America First” agenda, contrasting Japan’s US Steel bid. A delayed announcement might have let Trump tout a $7 billion win, yielding bigger gains.

Steel Plant Construction

4. Trump’s Next Moves and South Korea’s Opportunities

Trump’s tariff war is expanding to cars, semiconductors, and reciprocal trade, targeting India, Vietnam, and the EU—yet South Korea isn’t safe. While KORUS FTA offers a shield, Trump’s focus on slashing trade balance deficits could complicate matters.

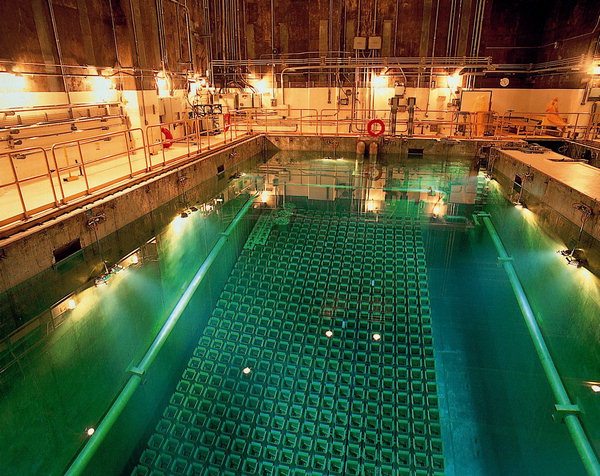

South Korea has a unique card: negotiating spent nuclear fuel reprocessing. With 19,000 tons stockpiled, reprocessing could cut radioactive waste by 95% and stretch 3-year uranium supplies to 80 years, turning waste into a resource. This could appeal to Trump’s deal-making instincts.

Spent nuclear fuel storage casks in nuclear power plants

Conclusion: South Korea’s Smart Play Ahead

Trump’s tariff war, centered on US Steel, the Nippon Steel takeover, aluminum tariffs, and trade balance, is intensifying. South Korea, a surplus nation, faces challenges but can leverage investments like Hyundai Steel’s plant and proposals like nuclear reprocessing for advantage. What’s your take on Trump’s trade moves? Drop a comment below!